How does a control balance sheet work?

Share

A control balance sheet (KBR) is a critical measure that a limited company in Sweden must carry out when there is a suspicion that the company's equity has decreased to less than half of the registered share capital. This can occur due to losses or impairments of assets. The purpose of KBR is to protect the company's board from personal payment liability and to ensure that the company has sufficient funds to continue its operations or make a decision on liquidation if the capital shortfall is serious.

Table of contents

- When and why is a control balance sheet prepared?

- Collection of documentation

- Preparation of the control balance sheet

- Decision at the general meeting

- The second control balance sheet and the eight-month deadline

- Valuation and revision of assets

- Personal liability and liquidation

- Summary

When and why is a control balance sheet prepared?

A KBR must be established as soon as the board suspects that the company's own capital has been used up to more than half of the registered share capital. This can be identified through regular financial reports or financial statements. Failure to establish a KBR in time can lead to the board members becoming personally liable for the company's debts and other commitments.

Collection of documentation

To begin the process, the company must collect all relevant documents, including the latest monthly report, balance sheets, and details of any hidden assets. It is also important to review accounts receivable and accounts payable and assess whether any assets can be revalued at a higher value than what is recorded. For example, properties or financial assets may have a higher market value than book value, which can be included in KBR.

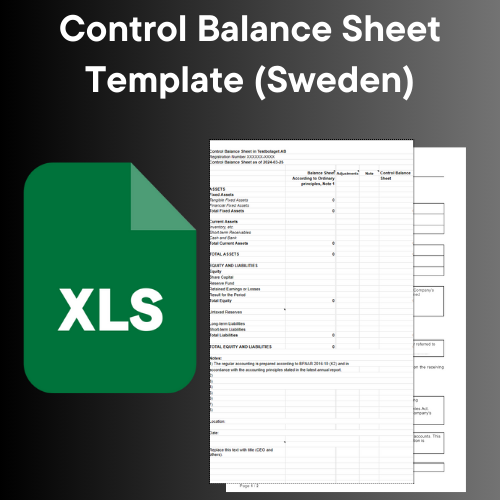

Preparation of the control balance sheet

Once all the necessary documents and data have been collected, the control balance sheet can be prepared. This must adjust for any excess values and hidden assets. KBR values the company's assets as if the business were to continue, but with a focus on identifying whether there is sufficient capital to sustain the business. Auditors should review the KBR if the company has one, but in some cases an internal review can also take place before a general meeting is held.

Decision at the general meeting

When the control balance sheet has been drawn up and reviewed, the company must hold a general meeting. During this general meeting, a decision is made as to whether the company should continue operations or go into liquidation. If the decision is to continue operations, the company has eight months to restore equity to at least the registered share capital. If this does not happen, the company must be liquidated.

The second control balance sheet and the eight-month deadline

If the company continues operations, a second control balance must be drawn up no later than eight months after the first. If this second KBR still shows that the capital has been used up, the company must be liquidated, otherwise the board and other responsible persons risk becoming personally liable. The second KBR can sometimes coincide with the regular annual accounts, but must still be clearly reported and carefully reviewed.

Valuation and revision of assets

A KBR differs from a regular balance sheet in that it allows a different valuation of assets, where, for example, the market values of real estate and financial assets can be adjusted upwards. This means that some assets may have a higher value than what is stated in the current accounts, which can contribute to restoring equity. It is also important to reserve for bad debts in order to give an accurate picture of the company's financial situation.

Personal liability and liquidation

If the company fails to restore the capital within the given time frame, the board must apply for liquidation. Failure to do this leads to the board becoming personally liable for the company's debts. This personal liability is retroactive and covers all debts incurred after it has been established that the capital has been used up to more than half.

Summary

A control balance sheet is an important tool to protect the company's board from personal liability in case of suspicion that the company's capital has decreased to critical levels. The process involves the company reassessing its assets and deciding on the future at a general meeting. If the capital is not restored within eight months, the company must be liquidated.