How to calculate a control balance sheet?

Share

Table of contents

1. Preparation: Collection of documents

To begin the preparation of a control balance sheet, you need a current financial statement, which can be either an interim financial statement or an annual financial statement. This financial statement must contain all assets, liabilities, equity, as well as the profit and loss account and balance sheet according to ordinary accounting principles.

Check the records: Before starting the preparation, make sure that all the records are up to date and correct. All assets and liabilities should be properly accounted for, and any adjustments needed to reflect fair values should have been made.

2. Valuation of assets and liabilities

In a control balance sheet, certain assets and liabilities may be valued in a different way than in the ordinary balance sheet. This step is important to ensure that the assets reflect their true value and not just the book value.

Assets: Assets such as real estate, inventory, and machinery can often have a higher value than the book value. In the control balance sheet, these assets can be valued at their sales value less costs to sell. If this value is higher than the book value, the assets can be written down.

Liabilities: Liabilities can be adjusted down if there is reason to believe they are overvalued. For example, long-term liabilities can be written down if the company has negotiated new, more favorable terms.

3. Calculation of equity

After adjusting assets and liabilities, the next step is to calculate equity. Equity is the difference between the company's assets and liabilities. If the equity, after adjustments, is less than half of the registered share capital, it is a sign that the company has a capital shortage, and further measures are required.

Formula for calculation:

Eget kapital = Tillgångar - Skulder

Adjustments: Add or subtract adjustments made to assets and liabilities as above to get the final value of equity.

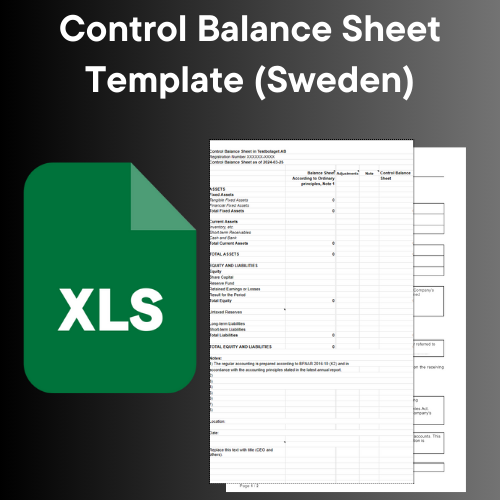

4. Prepare the control balance sheet

After you have calculated the adjusted equity, compile all the information into a control balance sheet. This must contain:

- Date of establishment: This is important as it governs when the various deadlines set out in the legislation start to run.

- All items from the balance sheet: These should include both original and adjusted values for assets and liabilities.

- Notes: Specify in notes which adjustments have been made and why. This is important for transparency and for the auditor to be able to review the bill correctly.

5. Review and approval by auditor

If the company has an auditor, this must review the control balance sheet. The auditor's task is to ensure that the valuations and calculations are correct and comply with applicable laws and regulations.

Auditor's note: The auditor must make a note confirming that the control balance sheet has been reviewed and approved. This should include the auditor's signature and the date of the review.

6. Decisions at the general meeting

If the control balance sheet shows that the equity is less than half of the share capital, the board must immediately call an extra general meeting (the so-called first control meeting). At this meeting, the shareholders must decide whether the company should continue operations or whether it should be liquidated.

Second control meeting: If the company decides to continue operations, a new control balance sheet must be drawn up within eight months, and a second control meeting held to determine whether the capital has been restored.

7. What happens if the capital is not restored?

If the capital has not been restored within the given period of eight months, the company must be liquidated. If the board does not follow this procedure, they may become personally liable for the company's debts.

Summary

Calculating and preparing a control balance sheet is a critical process to ensure the company's financial health and comply with statutory requirements. It is about carefully reviewing and adjusting the company's assets and liabilities, calculating the equity, and acting quickly if it turns out that the capital has been used up. By following these steps, companies can protect both their stakeholders and their board members from serious financial risks.