Control Balance Sheet - Valuation of various items

Share

Other Values or Valuation Methods Different from the Balance Sheet

Table of Contents

- Revaluation of Assets

- Intangible Assets

- Tangible fixed assets

- Financial Assets

- Properties

- Financial Debts

- Valuation of Assets on a Control Balance Sheet

- Valuation of Financial Fixed Assets

- Valuation of Untaxed Reserves

- Valuation of Tangible Fixed Assets

- Valuation of Accounts Receivable

- Valuation of Debt

- Valuation of Equity

- Summary

Revaluation of Assets

During a control balance sheet, certain items may be recorded at a different value than those reported in the balance sheet. This practice is commonly referred to as revaluation or fair value measurement. Here are some examples of items that can be revalued:

Intangible Assets

If there are indications that the value of intangible assets, such as trademarks or patents, has increased or decreased since they were first recognized on the balance sheet, they can be revalued to their fair value on a control balance sheet.

Tangible fixed assets

Buildings, machinery and equipment can be revalued if their market value or value in use has changed significantly since they were originally recorded on the balance sheet.

Financial Assets

Certain financial assets, such as shares or securities, may be revalued to their current market value if there have been significant changes in market conditions since they were first recognized on the balance sheet.

Properties

If the market value of properties has changed significantly since they were first included in the balance sheet, they can be revalued to their current market value.

Financial Debts

If market interest rates have changed since the liabilities were first recognized, financial liabilities can be revalued at their current market prices.

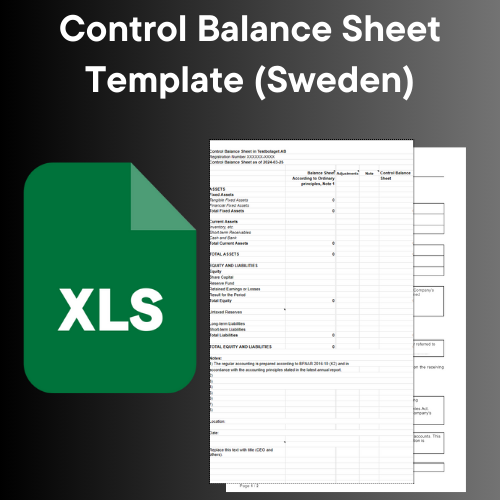

Valuation of Assets on a Control Balance Sheet

Cash and cash equivalents

Usually valued at the nominal amount because these assets are already liquid and easily converted into money.

Valuation of goods

In a control balance sheet in Sweden, goods, like other assets, must be valued at the lower of acquisition value and fair value in accordance with the Annual Accounts Act (1995:1554), the Companies Act (2005:551), and good accounting practice. The control balance sheet is a tool used to assess a company's financial health, particularly to determine if the company's equity is less than half of its registered share capital, which may signal a serious financial situation.

Principles and methods for valuation of goods

- Cost: Cost includes the purchase price, import duties and other directly attributable costs of bringing the goods to their current location and condition. It may also include a breakdown of indirect fixed and variable costs incurred in connection with the production or purchase of the goods.

- Fair value: Fair value is the price that could be obtained in the sale of an asset in a business transaction between informed, willing parties. For goods, this value can be the current market value, provided there is an active market. Fair value may be lower than acquisition value due to, for example, damage, obsolescence or changes in market demand.

- Impairment: If the fair value is lower than the acquisition value, a write-down must be made to the lower fair value. This reflects the loss of economic values and is in accordance with the precautionary principle of good accounting practice. Write-downs must be reflected in the control balance sheet to give an accurate picture of the company's financial situation.

It is important that the company carefully assesses and documents how the valuation of goods has been carried out when drawing up a control balance sheet. This assessment should be based on available and relevant information to ensure that the valuation is fair. For detailed rules and guidance, it may be appropriate to consult with a qualified accountant or accounting expert with experience in Swedish accounting practice and legislation.

Valuation of Financial Fixed Assets

With a control balance sheet, it is important to correctly value financial fixed assets in order to give a fair picture of the company's financial position. Here are some steps and guidelines for valuing these assets according to Swedish legislation and good accounting practice:

- Determine the historical cost of the asset: According to the Swedish Accounting Act (BFNAR 2007:1), financial fixed assets should initially be reported at the amount that has been paid for them or the value that was reached when the asset was replaced. This is called historical cost.

- Consider any write-downs: If there are indications that the value of the asset has been permanently reduced, a write-down should be made to reflect the new assessment of the value of the asset. According to Swedish rules (BFNAR 2012:1), write-downs should be carried out if there are indications that book values will not be recovered.

- Use market value if applicable: In some cases, it may be appropriate to use market value to value assets. If the asset is traded in an active market, the market value can be used as an indicator of its economic value.

- Assess future financial benefits: When assessing assets, it is also important to consider the future financial benefits that the asset is expected to generate for the company.

- Carry out a regular review: As economic conditions can change over time, it is important to regularly review and possibly reassess the value of financial fixed assets to ensure that they are reported at fair value.

It is also important to note that changes in the valuation of assets must be properly documented and comply with the relevant accounting principles and legislation. For detailed guidance, it is recommended to consult an authorized accountant or accounting expert with knowledge of Swedish accounting practice.

Valuation of Untaxed Reserves

Untaxed reserves are one type of reserve that can appear on a control balance sheet. These reserves represent accumulated profits that have been retained by the company and have not yet been distributed to shareholders through dividends or otherwise taxed.

In a control balance sheet, untaxed reserves may appear as a separate item under equity or as part of another account, depending on accounting methodology and regulations.

Untaxed reserves can arise for a variety of reasons, including:

- Accumulation of profits: The company has achieved profits over time that have not been distributed to shareholders but have been retained in the company for future use or investment.

- Reserved for specific purposes: Certain profits may be reserved for specific purposes, such as expansion projects, research and development, or to meet future risks or expenses.

- Capitalization of profit: Instead of distributing the profit to the shareholders, the company may choose to capitalize the profit by using it to improve the financial position of the company or to finance growth and expansion.

Untaxed reserves can be important to a company's financial stability and growth, as they represent capital available to the company to meet future needs or investments without having to take outside capital or pay dividends to shareholders. In a control balance sheet, it is important to carefully review and verify the size and use of untaxed reserves to assess the company's financial strength and potential distribution capacity.

Valuation of Tangible Fixed Assets

In the case of a control balance sheet, correct valuation of tangible fixed assets is essential to give a fair picture of the company's financial position. Below are some steps and guidelines for valuing these assets according to Swedish legislation and good accounting practice:

- Determine historical cost: According to the Swedish Accounting Act (BFNAR 2007:1), tangible fixed assets should initially be reported at the amount that has been paid for them or the value that was established when the asset was replaced. This is called historical cost.

- Consider depreciation: Tangible fixed assets, such as buildings, machinery and fixtures, usually have a limited useful life. Therefore, depreciation should be made to reflect the gradual decline in the asset's value over its useful life. Depreciation should be based on the expected use and economic life of the asset.

- Assess for any impairment: If there are indications that the value of a tangible fixed asset has been permanently reduced, for example due to technological changes or physical wear and tear, an impairment should be made to reflect the new assessment of the asset's value.

- Consider salvage value: According to the Swedish Accounting Act (BFNAR 2007:1), salvage value must be considered when there are indications that the value of an asset has decreased. Salvage value is the amount for which an asset can be sold or converted after it has served its useful life.

- Carry out regular reviews: As economic conditions and the value of assets can change over time, it is important to regularly review and possibly reassess the value of tangible fixed assets to ensure that they are reported at fair value.

Valuation of Accounts Receivable

Accounts receivable are generally valued at the amount expected to be received from customers, adjusted for any bad debts or write-offs. With a control balance sheet, it is important to assess the value of accounts receivable carefully to ensure that they are reported correctly.

Valuation of Debt

Accounts payable

Valued at the amount the company expects to pay to suppliers for goods or services that have been delivered.

Loans and interest-bearing liabilities

Valued at the face amount, which is the amount originally borrowed or issued, plus any accrued interest.

Tax obligations

Valued at the amount the company is expected to pay in taxes based on current tax rates and legislation.

Valuation of Equity

Paid-up share capital

Represents the amount that the shareholders have invested in the company and is valued at the nominal amount of the shares issued.

Cumulative results

Valued at the accumulated amount of the company's earned profits or losses over time.

It is important to note that the valuation methods may vary depending on the company's size, industry and accounting standards applied. In addition, there may be specific rules and guidelines that apply to the valuation of certain assets or liabilities under local law or international accounting standards.

Summary

Carrying out a trial balance means that certain items can be revalued to better reflect their fair value. This includes intangible assets, tangible fixed assets, financial assets, real estate and financial liabilities. By using revaluation, companies ensure that their financial reporting gives a true and fair view of their financial position. It is important to follow the guidelines and laws that apply to the valuation and revaluation of assets and liabilities. This includes documenting all assessments and changes carefully to ensure transparency and compliance. A carefully executed control balance sheet helps identify and manage potential financial problems before they escalate, further contributing to the company's long-term success and sustainability.