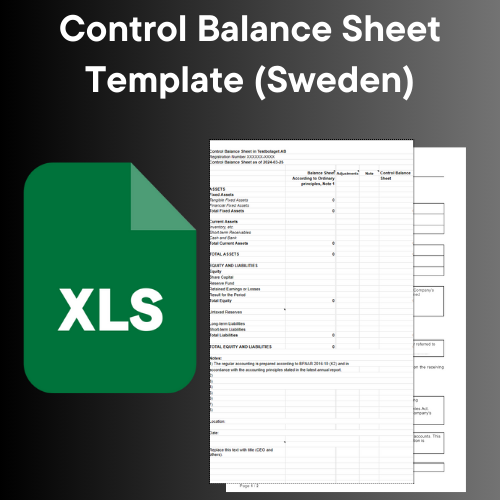

Control balance sheet Notes/Notes/Appendices

Share

Notes, Notes and Appendices when preparing a Control Balance Sheet

Table of Contents

- Accounting principles and Assessments

- Notes to Specific Items

- Explanations of Changes

- Clarification of Uncertainties

- Reporting of Events after the Balance Sheet Date

- Appendices

- Advantages of Detailed Notes and Appendices

- Example of Specific Notes

- Final Thoughts

- Summary

Accounting principles and Assessments

When preparing a control balance sheet, it is crucial that the accounting principles and key judgments made by the company are clearly stated. This may include:

- Depreciation methods: How different assets are depreciated over time and which methods are used.

- Valuation of assets: Principles of how different types of assets, such as property, machinery and equipment, are valued.

- Accounting for income and expenses: What principles are used to account for income and expenses, including the accrual and matching of income and expenses.

- Assessments and estimates: What important assessments and estimates the company has made when preparing the balance sheet, such as assessment of impairment needs and provisions.

Notes to Specific Items

For each item in the balance sheet, such as assets, liabilities and equity, there should be detailed notes. These notes should provide further information on what each item includes, how it has been calculated and any restrictions or caveats that are relevant. Examples include:

- Assets: Notes can specify different types of assets, such as property, machinery, inventory and receivables, and provide details of their valuation.

- Liabilities: Notes can describe different types of liabilities, including long-term and short-term liabilities, and provide information about their terms and due dates.

- Equity: Notes may provide details of changes in equity, such as new issues, dividends and share buybacks.

Explanations of Changes

Notes should also be used to explain changes in various items compared to the previous period. This may include:

- Changes in assets: Description of why certain assets have increased or decreased in value, including acquisitions, disposals and write-downs.

- Changes in liabilities: Explanation of new liabilities incurred or liabilities paid off.

- Changes in equity: Statement of changes in equity, such as new issues, dividends and changes in earnings.

Clarification of Uncertainties

If there are uncertainties or risks affecting the company's financial position, these should be clarified in the notes. This may include:

- Litigation: Information about ongoing or threatened litigation and their potential financial consequences.

- Economic Uncertainties: Description of economic uncertainties, such as fluctuations in commodity prices, exchange rate risks and credit risks.

- Changes in market conditions: How changes in market conditions, such as interest rates and economic changes, can affect the company's financial position.

Reporting of Events after the Balance Sheet Date

Notes may also include information about events or transactions that have occurred after the balance sheet date but which may have a significant impact on the company's financial position. Examples include:

- Significant acquisitions or disposals: Description of significant acquisitions or disposals of assets that have occurred after the balance sheet date.

- Changes in laws and regulations: Information about new laws or regulations that may affect the company's financial reporting.

- Significant business events: Information about significant business events, such as major customer deals or lost contracts.

Appendices

As far as appendices are concerned, they should contain additional supporting documentation and supporting documents that substantiate the information reported in the balance sheet and notes. This may include:

- Invoices: Copies of invoices supporting data on income and expenses.

- Agreements: Copies of important agreements, such as leases, supplier agreements and loan agreements.

- Bank Statement: Statements from bank accounts confirming balances and transactions.

- Inventory Lists: Lists of the company's inventory and their valuation.

- Audit reports: Reports from auditors confirming the accuracy of the financial statements.

Advantages of Detailed Notes and Appendices

Including detailed notes and appendices in a control balance sheet has several advantages:

- Transparency: Provides a clear and distinct picture of the company's financial position and results, which increases the confidence of investors and other stakeholders.

- Compliance: Ensures that the company complies with applicable accounting standards and laws, reducing the risk of legal problems and penalties.

- Decision Support: Provides detailed information that can be used by management and external stakeholders to make informed decisions.

- Risk Management: Helps identify and manage financial risks by providing insight into uncertainties and potential problem areas.

Example of Specific Notes

To further clarify the importance of notes when drawing up a control balance sheet, the following example can be used:

- Fixed Assets: A note may include information on acquisition values, depreciation methods, accumulated depreciation and any impairment charges. It can also describe which fixed assets have been bought or sold during the period.

- Current Assets: Notes can provide details of inventory, accounts receivable and cash and cash equivalents. For example, an inventory note may include information on inventory turnover rates, inventory losses, and obsolescence assessments.

- Liabilities: Notes can describe both long-term and short-term liabilities, including interest, repayment plans and any collateral pledged for the loans.

- Equity: A note on equity may include information on share issues, capital contributions, reserves and retained earnings.

Final Thoughts

Preparing a control balance sheet with extensive notes and appendices is not only a necessity to meet statutory requirements, but also an opportunity to improve the company's internal control and financial management. By providing a clear and detailed picture of the company's financial position and the assessments that form the basis of the accounting, the company can strengthen its trust with investors, creditors and other stakeholders. A well-executed control balance sheet also helps identify and address potential problems before they escalate, further contributing to the company's long-term success and sustainability.

Summary

In summary, notes, notes, and appendices are important supplementary documents that provide additional information and clarifications to properly understand and assess a control balance sheet. Their correctness, clarity and relevance are essential to ensure transparency and reliability in the company's financial reporting. By carefully following the guidelines and requirements placed on these documents, companies can ensure that their financial reports are both fair and informative, which in turn helps to strengthen the trust of all stakeholders.