Control Balance Sheet - Implementation, Questions and Answers

Share

Implementation of a Control Balance Sheet

Table of Contents

- Collection of Documents and Data

- Creation of Control Balance Sheet

- Review Relevant Accounts in the Balance Sheet

- Compilation of the Review

- Documentation and Storage of All Documents

- Common Questions and Misunderstandings

- Summary

Collection of Documents and Data

Firstly, it is important to collect all relevant documents and data, including previous balance sheets, transaction history and bank statements. This information will form the basis of the upcoming review.

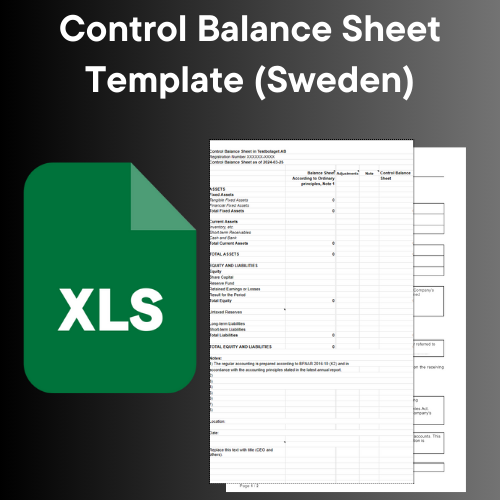

Creation of Control Balance Sheet

The control balance must be drawn up immediately. Exactly what "immediately" means is not defined in the law's preparatory works. The time frame for drawing up a control balance can be affected by various factors, for example the need for stock inventory or possible vacation time. According to practice, the control balance sheet is drawn up within one month for smaller companies and within two months for larger companies.

To create a control balance sheet, the limited liability company must comply with the Annual Accounts Act. When calculating the amount of equity, certain adjustments can be made. The board, with at least half of the members, must sign the control balance sheet. If one or more members have a different opinion, it must be noted in the board minutes and attached to the balance sheet.

Read more on the Accounting Board's website for additional information on control balancing and related laws and regulations.

Review Relevant Accounts in the Balance Sheet

The next step is to carefully review and analyze the various accounts in the balance sheet. This means verifying that the numbers are accurate and that any deviations or anomalies are identified and thoroughly investigated. It may also involve comparing current figures with previous periods to spot any unusual changes.

During the audit, it is also important to check that all transactions and items are correctly accounted for and classified in accordance with applicable accounting principles and rules. This includes ensuring that assets and liabilities are reported at their fair values and that any depreciation or write-downs have been properly carried out.

Compilation of the Audit Carried Out

After completing the review, it is important to compile the results and any recommendations or actions that need to be taken. This may include reporting any deviations to management or auditors and suggesting improvements to internal controls or accounting processes to minimize the risk of errors in the future.

Documentation and Storage of All Documents

Finally, it is important to document the entire process carefully for future reference and audit traceability. This includes keeping copies of all documents and analyzes performed during the review and following up on any actions or recommendations made as a result of the review.

Common Questions and Misunderstandings

Does an auditor have to review a control balance sheet?

No, an auditor does not have to review a trial balance sheet. But if the company has had an auditor before, it is usually the practice for the auditor to review the control balance sheet. A control balance sheet is an internal process to assess the accuracy and reliability of the company's financial reporting, and it is up to the company itself to determine if and when such a control is needed.

The auditor's role is to review and verify the company's annual report and financial statements to assess whether they give a true and fair view of the company's financial position, results and cash flows according to applicable accounting principles and laws. The auditor performs this review by assessing the company's internal controls, analyzing transactions and accounting, and performing other necessary steps to assess the company's financial reporting process.

If the company chooses to prepare a control balance, the auditor may, if requested by the company or its stakeholders, include this control balance as part of its audit. The auditor can then use the internal control balance sheet as a basis and support for his review of the company's financial reports.

In conclusion, it is up to the company to decide whether a control balance should be carried out and whether the auditor should be involved in this process. The auditor does not need to review a control balance sheet as a separate task, but can use it as a basis for his audit of the company's financial statements.

Is the control balance sheet public?

A control balance sheet is typically an internal process and document used by the company's internal management and auditors to assess the accuracy and reliability of the company's financial reporting. Because it is an internal process, the control balance sheet is not usually intended for public distribution or for the eyes of outside stakeholders.

In contrast, the annual report, which includes the official balance sheet, income statement and notes, are usually public documents that must be submitted to the Swedish Companies Registration Office and thus become available to the public. These public documents may contain information derived from the internal control balance sheet, such as adjustments or comments made on the basis of its results.

It is important to note that while the control balance sheet itself is usually not public, information derived from it may be part of the official annual report that is public and available to external stakeholders and the public.

Summary

Carrying out a control balance sheet is a method of ensuring that the financial reporting is accurate and reliable. By carefully following the steps of collecting documents and data, preparing the control balance sheet, reviewing relevant accounts, compiling the review and documenting the entire process, a control balance sheet can be performed effectively. This helps to ensure that the company's financial reports are accurate and reliable, which in turn strengthens the confidence of stakeholders and improves overall financial governance.